Running out of money during retirement is a serious risk that many retirees face. Not knowing how to create income through tax-advantaged withdrawals from retirement accounts is a common problem, and too many retirees aren’t provided proper retirement income planning services that could save them from future financial disaster. At 360 Wealth Management, we have developed an exclusive focus on retirement income maximization within our financial planning process to help make sure that our clients never run out of money during retirement.

RETIREMENT PLANNING

01

Retirement Planning

Retirement Income Maximization is Key

By taking the time to understand your life situation and financial landscape, we help guide you through your Social Security benefits.

02

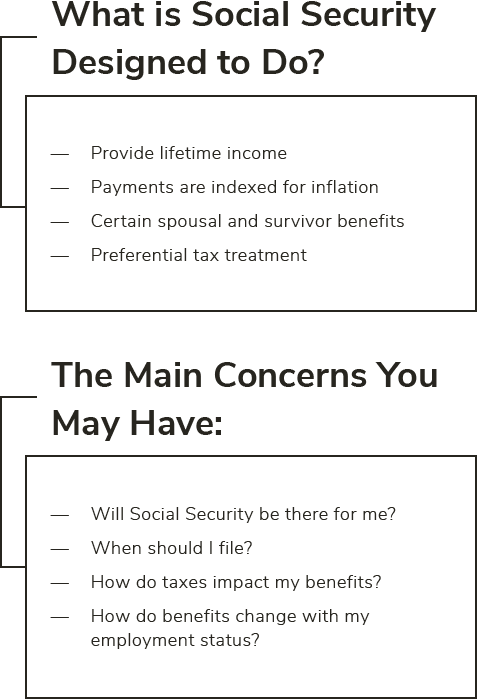

Social Security Maximization

When You File Is Not the Only Consideration

While you can file for Social Security at age 62, waiting until full retirement age increases your benefit by around 30% for the rest of your life. Waiting until age 70 increases your benefit even more, by 8% per year. But those are not your only considerations. Couples and people who were married at least 10 years but are now divorced have a lot of options when it comes to Social Security. There are specific ways to file that can optimize the lifetime benefits you receive depending on your unique situation, and we can help you run the calculations.

03

Medicare Supplemental

(Medigap) & Advantage Plans

Guiding Clients Through the Medicare Experience

Almost everyone, except possibly those still working for large companies, should file for Medicare at age 65. (You will be automatically enrolled if you have already filed for Social Security.) Medigap and Medicare Advantage polices are extra health insurance that you buy from private health insurance companies to pay health care costs not covered by Original Medicare, such as copayments, deductibles, and health care if you travel outside the U.S. We guide clients through the Medicare/Advantage/Medigap policy shopping experience, making plan recommendations according to our fiduciary standard.

04

Health Savings Accounts (HSAs)

Tax-Advantaged Savings for Health Care

Health Savings Accounts (HSAs) are tax-advantaged accounts that can be created for individuals covered under high-deductible health plans (HDHPs) enabling them to save for qualified medical expenses that are over and above an HDHPs coverage limits and/or exclusions. While you cannot continue to contribute to an HSA after you file for Medicare or Social Security, you can use the funds you have saved for qualified medical expenses throughout retirement and any gains on the accounts can continue tax-free so long as they are used for medical costs. We can explain the benefits of HSA accounts, determine if you are eligible, and provide product recommendations with a fiduciary standard in mind.

05