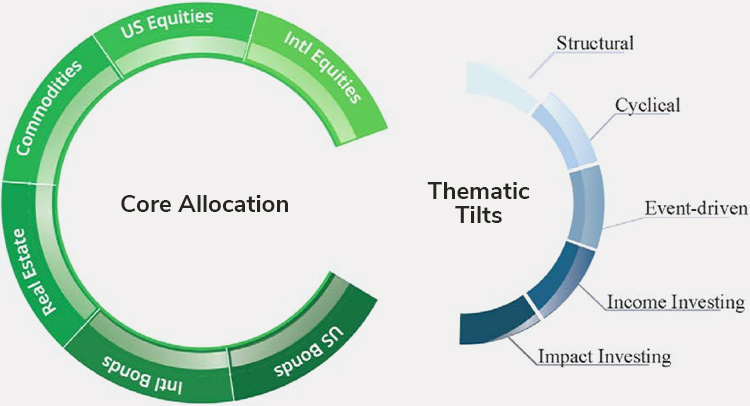

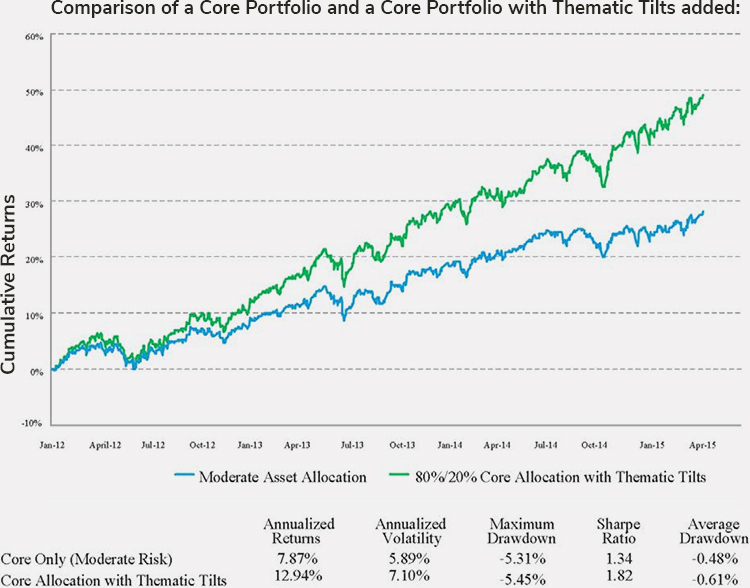

360 Wealth Management’s core-thematic approach emphasizes the low-cost diversification properties of passive investing within the core portfolio, but also recognizes that there are major secular, structural, and cyclical influences that are shaping the global economy. Our approach employs a forward-looking lens with the satellite component of the investor’s portfolio to act on these macro-trends through investments that are called “thematic tilts.” We believe that a core allocation with thematic tilts can lead to more efficient portfolio construction.

PORTFOLIO MANAGEMENT

01

Portfolio Management: Ideas In Action

The Best of Both Worlds

02

The Thematic Tilt Portfolio Catalog

- BOTZ (Robotics & Artificial Technology ETF)

- SNSR (Internet of Things EF)

- FINX (FinTech ETF)

- SOCL (Social Media ETF)

- HERO (Video Games & Esports ETF)

- LIT (Lithium & Battery Tech ETF)

- DRIV (Autonomous & Electric Vehicles ETF)

- CLOU (Cloud Computing ETF)

- BUG (Cybersecurity ETF)

- AIQ (Artificial Intelligence & Technology ETF)

- MILN (Millennials Thematic ETF)

- EBIZ (E-commerce ETF)

- EDUT (Education ETF)

- POTX (Cannabis ETF)

- GNOM (Genomics & Biotechnology ETF)

- EDOC (Telemedicine & Digital Health ETF)

- LNGR (Longevity Thematic ETF)

- BFIT (Health & Wellness Thematic ETF)

- GXTG (Thematic Growth ETF)

03

Leveraging Intelligent Tax Management Monthly

To Get More Out of Your Portfolio

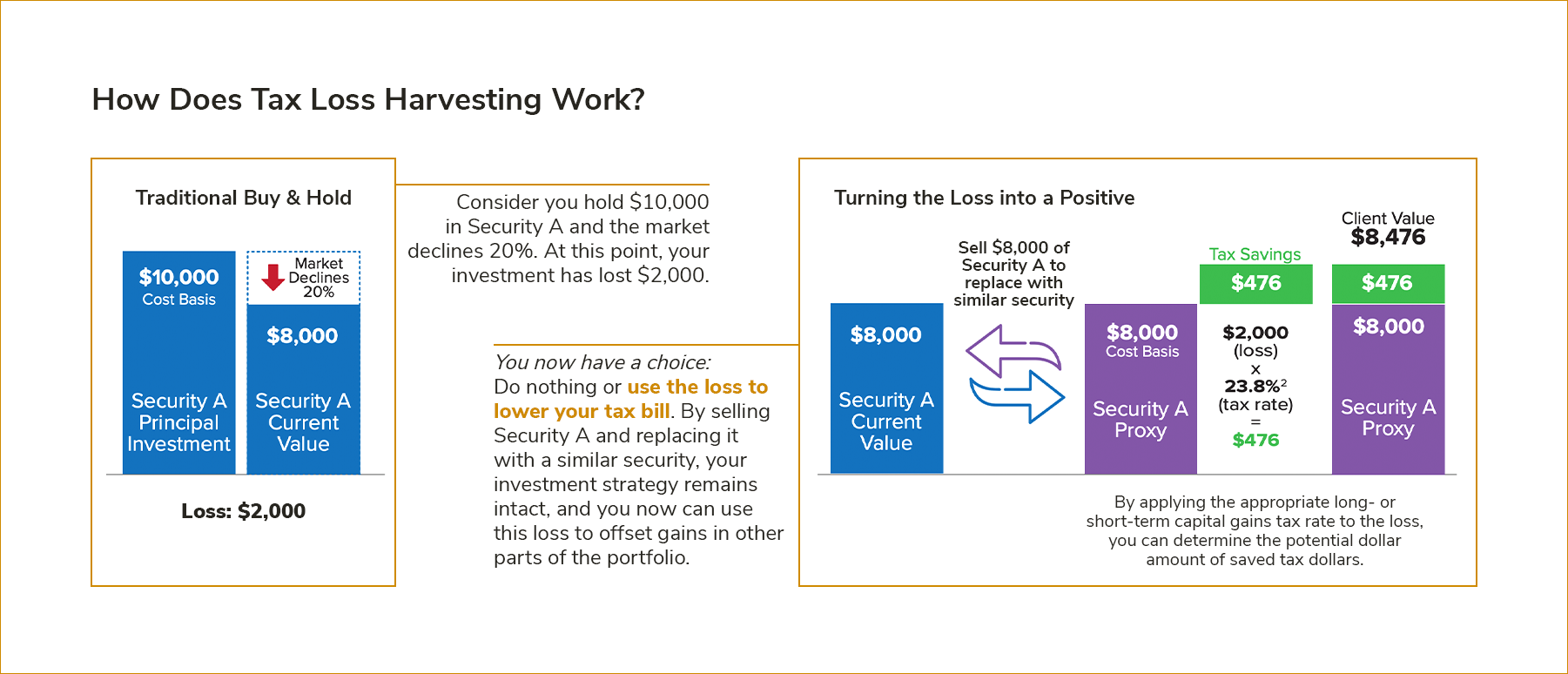

To truly optimize your portfolio, we utilize a monthly strategy to help take advantage of losses. Even temporary market drops can provide opportunities to reduce your current tax bill and potentially increase your long-term wealth. Tax loss harvesting (TLH) is a key feature of tax-smart investing. TLH looks to capture investment losses in your portfolio that may be used to offset your near-term tax liabilities and increase your after-tax returns.

Save on Taxes This Year:

By using losses to offset gains—potentially up to $3,000 of income—the investor can lower their tax burden in the near term. Capture value: If the market recovers its losses, the client retains the value created by tax-loss harvesting and can even keep the money invested, earning additional returns.

04

Rebalancing and Risk Indicators

And How They Benefit You

360 Wealth Management, Inc.’s “Powered by 55ip’s Market Risk Indicator (MRI)” is a risk-management tool that is intended to protect investors from extreme losses. The MRI Score utilizes over a dozen quantitative metrics across global markets to forecast risk, guiding allocation between equities markets and a shelter basket (cash equivalents). The philosophy behind protecting against large losses is driven by the long-term client benefit of rebalancing allocations during the most tumultuous economic periods when investors are subject to the risk of extreme market moves, both up and down. MRI evaluates indicators across four categories to assess the risk/reward environment, resulting in a score that can range from 0 (low risk) to 100 (high risk).

05

Read Our Latest Articles

Stay up to date with our latest articles about finance, markets and legislation.

Schedule a Free Demo

At 360 Wealth management we have created an ideal environment for the implementation of a core-thematic approach. Schedule a free demo to see how investors can take advantage of this opportunity by working with 360 Wealth Management, Inc. as part of their holistic wealth management strategy.