Investors today are faced with more challenges than ever. Markets are not behaving the way they used to as fiscal and monetary policies continue to have unintended consequences. Investors from all walks of life are asking the same questions: When will I be able to retire? How do I ensure my income will last as long as I do? How will I manage the rising costs of medical services? How will changes in taxes and inflation impact my plans for the future? Ultimately, these questions are all a different way of asking the real question that is on everyone’s mind: So, what do I do with my money?

01

Fiduciary Financial Advice Is More Important Than Ever

It’s not the same world it was a decade ago.

It all begins with change... When life changes, money changes. When money changes, life changes.

02

Why 360 Wealth Management in Scottsdale

A 360-degree view and vision for your finances.

DISCOVER OUR APPROACH

LEARN ABOUT US

OUR TECHNOLOGY

LEARN ABOUT WILLIAM WILKINSON III

READ ABOUT OUR PORTFOLIO MANAGEMENT

TAX AND ESTATE PLANNING

LEARN ABOUT RETIREMENT PLANNING

03

We Look Forward to Being Your Lifetime Financial Advisor

At 360 Wealth Management, we are dedicated to the lifetime success of you and your loved ones, which includes being by your side during transitional moments in your life. No matter what changes come your way, we’ll work together to help you move forward with confidence.

Go confidently in the direction of your dreams. Live the life you have imagined.

― Henry David Thoreau

04

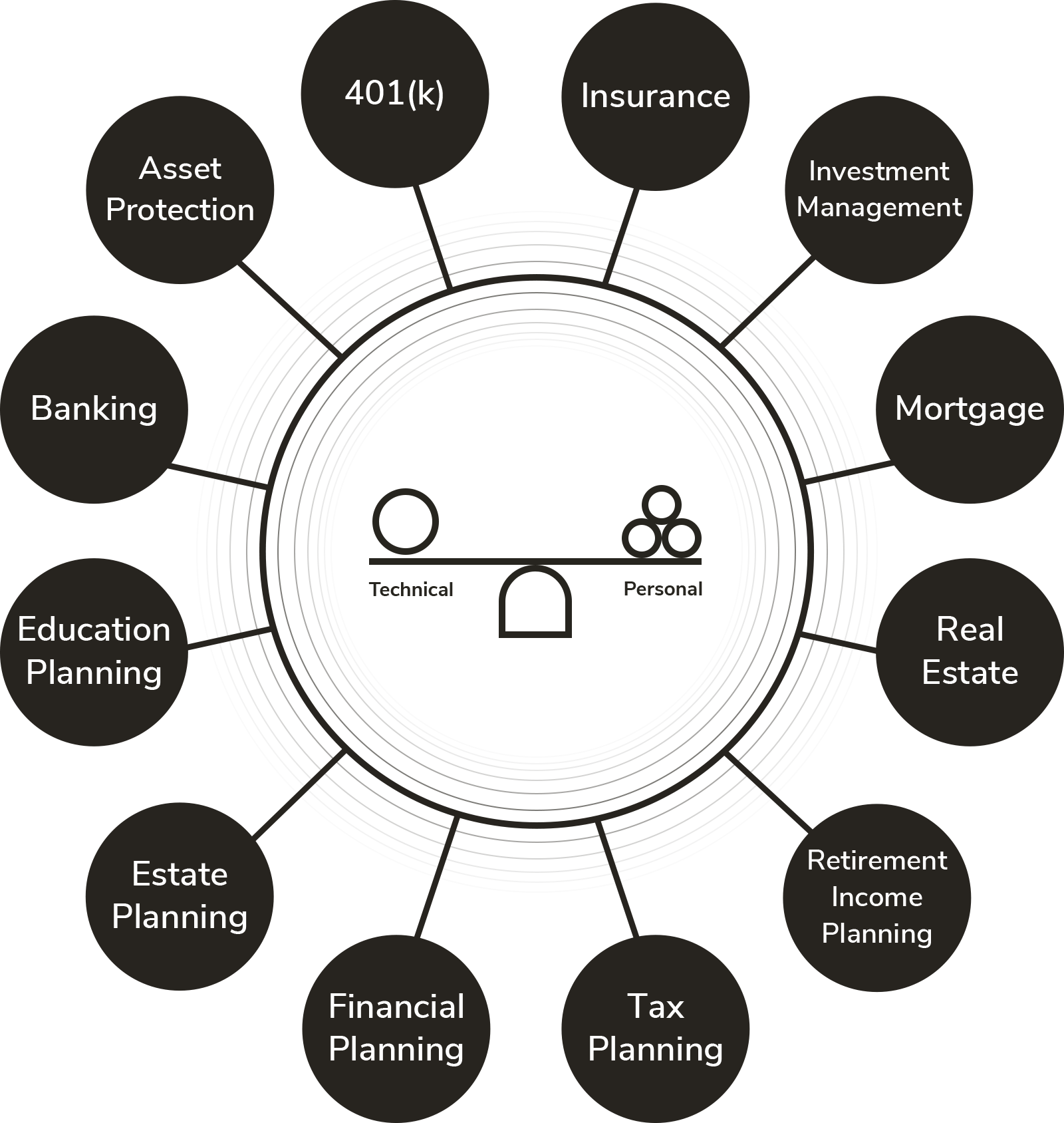

What We Mean by Comprehensive Planning

Your personal financial ecosystem.

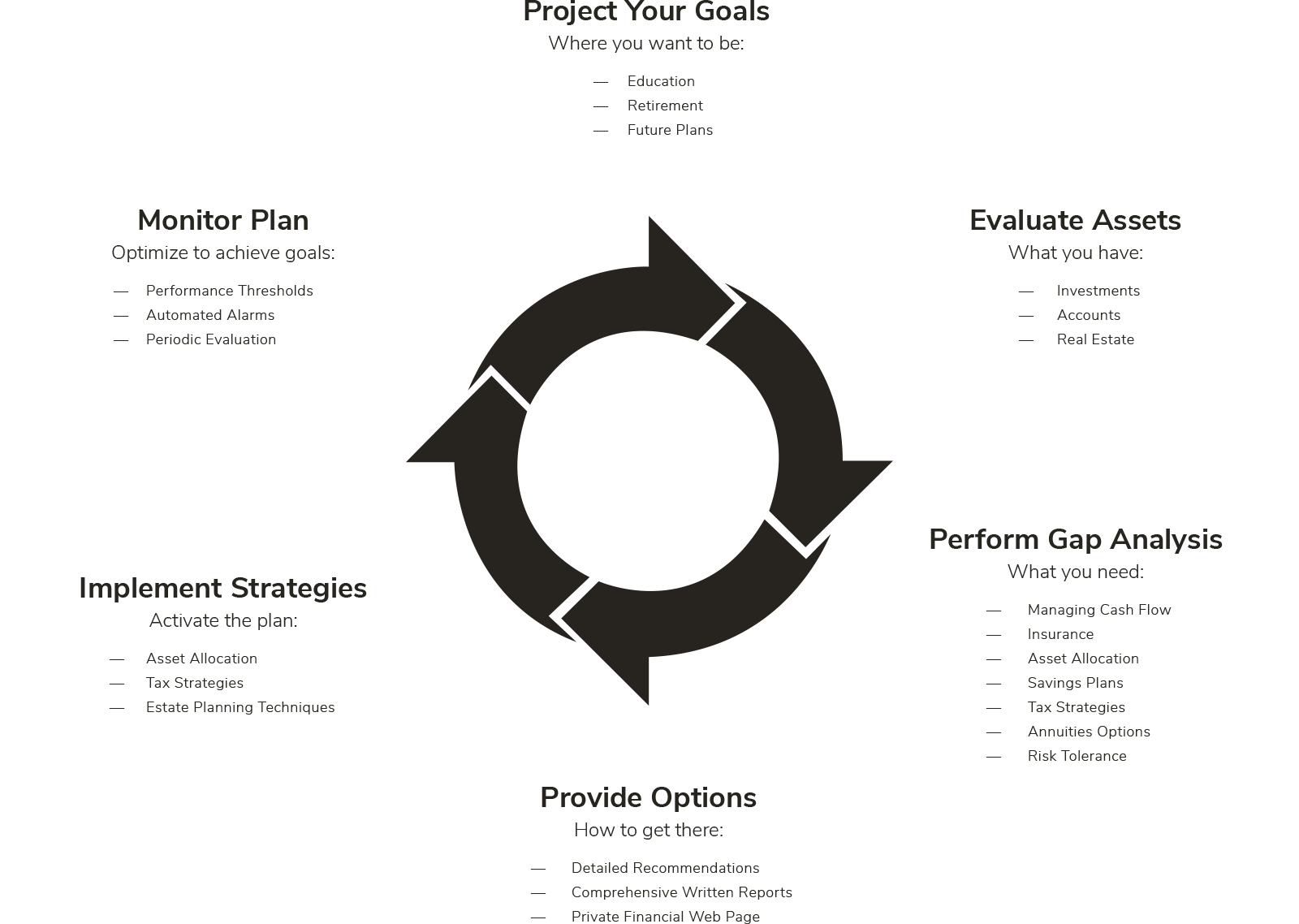

We start by helping you identify your goals and evaluate where you are relative to those goals. We look at every possible aspect of your financial life, from your 401(k) to your mortgage to your taxes and more—your entire personal financial ecosystem. We evaluate your options and recommend strategies to get you where you want to be. But we don’t stop there. We help you implement the recommendations. Then, we continually monitor your financial situation to ensure you remain on track to achieve your financial dreams.

Your Personal Financial Ecosystem

Coming together is a beginning; keeping together is progress; working together is success.

― Henry Ford

06

Well-Being, Well Done

A comprehensive view of your complete financial picture.

A deeper understanding is required to help you achieve your goals. Your well-being is a dynamic state, ebbing and flowing as your life moves. It’s a very personal experience, one which you create and protect through the choices you make. There are aspects you can feel and those you can count on. Both are equally important. There are no shortcuts to success, and we commit to our clients for a lifetime.

Our Planning Process Can Help You

Achieve Your Financial Dreams

07